Engulfing Candlestick Pattern

Engulfing Candlestick Pattern :

Engulfing Candlestick Pattern, market analysis mein istemal hone wala aham candlestick pattern hai, jo trend reversal ko darust karta hai. Ye pattern do alag candlesticks ke through represent hota hai aur indicate karta hai ke market sentiment mein taqat ka ailaan ho sakta hai.

Engulfing Candlestick Pattern ka Tazkirah:

- Dekhne Mein Kaisa Hota Hai:

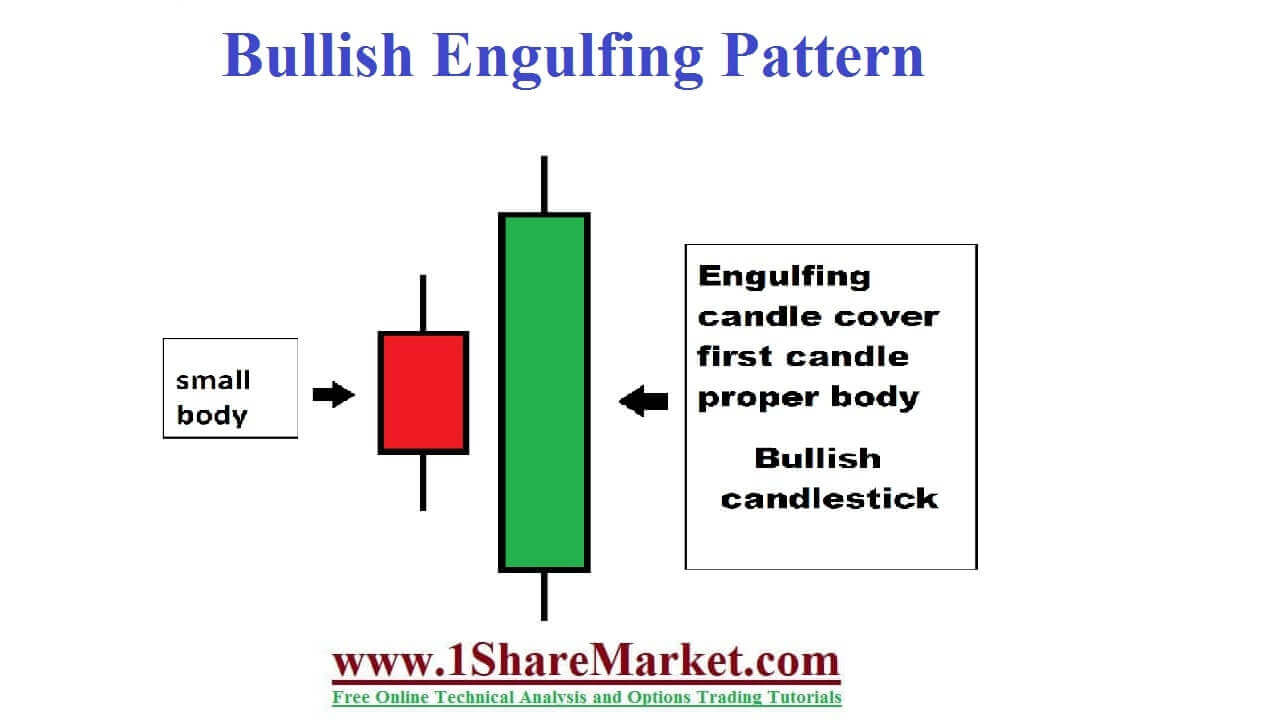

- Engulfing pattern mein do candlesticks hote hain: pehla candlestick chhota hota hai aur doosra candlestick pehle wale ko poora engulf kar leta hai.

- Bullish Engulfing: Pehla candlestick bearish hota hai aur doosra candlestick usko puri tarah engulf kar leta hai. Yeh bullish reversal ko darust karta hai.

- Bearish Engulfing: Pehla candlestick bullish hota hai aur doosra candlestick usko poora engulf kar leta hai. Yeh bearish reversal ko darust karta hai.

- Kya Darust Karta Hai:

- Bullish Engulfing pattern ka appearance bearish trend ke baad indicate karta hai aur bullish reversal ke chances ko point out karta hai.

- Bearish Engulfing pattern bearish trend ke baad aane wale possible bullish reversal ko indicate karta hai.

- Trading Strategy:

- Agar engulfing pattern confirm hota hai, toh traders is signal ko consider karke apne trading strategies ko adjust kar sakte hain.

- Bullish Engulfing ke baad, traders buying positions enter kar sakte hain aur Bearish Engulfing ke baad, selling positions enter kar sakte hain.

- Thawabit-e-Dimaagh:

- Engulfing Candlestick Pattern ek indicator hai, aur isay dusre technical analysis tools ke saath mila kar istemal karna behtar hota hai.

- Trading decisions mein risk management ka khayal rakhna zaroori hai.

Yeh pattern market participants ke sentiment mein taqat ka ailaan karta hai, lekin hamesha yaad rahe ke ek single pattern par pura bharosa na karen aur dusre technical indicators aur market conditions ko bhi mad-e-nazar rakhen.

تبصرہ

Расширенный режим Обычный режим